Make money, spend money: Gifts, groceries, housing, transportation, utilities, health, entertainment, and more. If you know the cycle of your life, you know this is the reality. And you probably aren't going to change that reality. But if you spend money wisely, the cycle will be a lot easier to manage, and even more fun, too.

Be a FoolProof Skeptic, and the money you have will go further. You'll respect yourself more. And even your overall health and wellness may improve.

So, here's the secret to spending money the right way: always, and I mean always, be a healthy skeptic. A healthy skeptic is a FoolProof Skeptic.

This is what FoolProof is all about:

Be a healthy FoolProof Skeptic when it comes to anyone who (or any company that) wants to touch your money or impact your wellbeing.

FoolProof Skepticism is as important to your life as food. Be a FoolProof Skeptic, and the money you have will go further. You'll respect yourself more. And even your overall health and wellness may improve.

FoolProof Skepticism

So, here's how to glue FoolProof Skepticism in your brain.

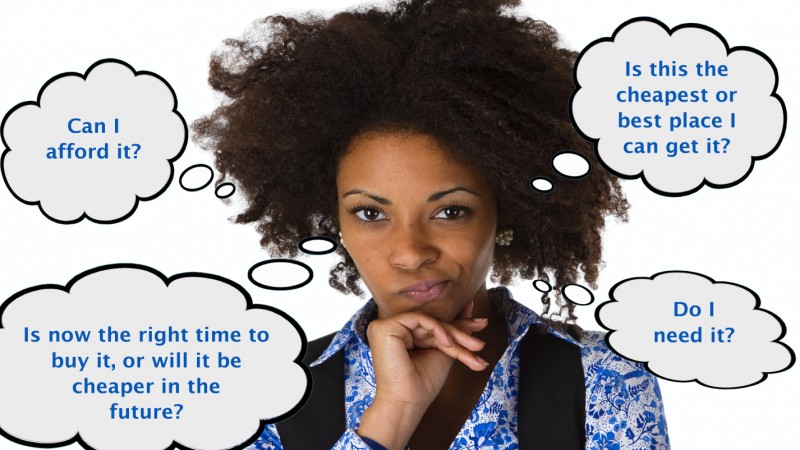

Memorize these 4 simple—but explosively powerful—questions before buying anything:

-

Do I need it?

Do you need it to survive? Or do you just want it? That can be a $500,000 question (The approximate amount of money you can throw away in your lifetime on purchases you don't need to make, or can get cheaper). -

Can I afford it?

Don't kid yourself here. For most everyday things, or toys and gadgets, if you can't afford to pay cash, you can't afford it. At least right now. Should you buy now, or save and buy in a while? And if you are impulse buying (which some people do all the time), please don't ever finance those impulse buys. -

Is this the cheapest or best place I can get it?

Cheap may be good, but not if the quality is bad. What are you looking for? Are there less-expensive alternatives that fill your want/need? Does this place have the best customer service and warranty? Are they reliable? Maybe you should compare price and quality, first... Is now the right time to buy it, or will it be cheaper in the future?

This is yet another question to help stop your impulse buying habit! At certain times it may be cheaper to buy certain items than others. Think of Black Friday and electronics, for example. But consider too, that buying on a "cheap day" isn't smart if you can't afford what you want to purchase!

Four simple questions! You can memorize those, right? Try them this week. What do you have to lose (other than money)?

More tips for the seriously interested: If you're looking to learn more, check out the FoolProof resources below and use them to become that FoolProof Skeptic.

Here's to memory glue...

Will

#1 - Have oversight of your finances

How often have you been short on cash or forgotten to pay a bill? You'd think that in this digital age it would be easier to keep track of funds and bills, right? Digital reminders, automatic payments... And there's basically a service, an app, or website for every financial convenience...

Believe it or not, the move of our finances to the web may actually make it harder for people to keep oversight! Keep oversight now.

#2 – Mobile and app payments

For many people, "contactless" payments and payment apps (or money transfer apps) are the trend and the convenient way to go. But are they safe?

Scams lurk around the corner, if you don't handle these accounts (and your personal and financial information associated with them safely) right. But your biggest enemy is probably impulse spending. Break the cycle by reading our article and video on mobile payments and payment apps.

#3 - Safely managing your student loan(s)

Our FoolProof Student Loan Guide provides the action steps and resources you need to manage student loan debt. You'll find it in our student guide section.

#4 - Secondhand vs. new

Young people spend most of their cash on smaller items like clothing, electronics and entertainment. Why not try buying those items used? It's cheaper, and the selection can be just as good. Find great tips in our "buying secondhand" article.

#5 – Manage your money with a credit union or local bank

Life is a lot easier if you have a checking account. Not only is it a safe place to store your money, but you'll you get a debit card that is linked to your checking account, to be able to go online and make purchases, and you can pay someone with a check if you don't have cash on you.

But be careful: Hundreds of financial institutions want you to open your first checking account with them. Some will try to rip you off, while others will do their best to help you. So, how do you pick the right banking partner? Our article on checking accounts may help.

#6 - Funky saving tips

Life seems to be getting more and more expensive. So, whenever I get the chance to save some money, I take advantage of it! Need a few different ways to save money, too? Head to "FoolProof's Top 5 Funky Saving Tips" article now.

#7 - All about your credit

You've heard of credit scores, right? But do you know how important that credit score is to the rest of your life?

Credit impacts almost everything that you do. Therefore you better learn the ins and outs in our "all about credit" article, right now.

#8 - Future-proof job

As society and technology changes, working conditions also change and so do the professions of the future.

FoolProof did some research, and compiled a list of ten future jobs we think you might consider applying for, based on workforce trends. Have a look at our "future job" article and/or video.